The Impact of Cryptocurrency on Modern Financial Systems

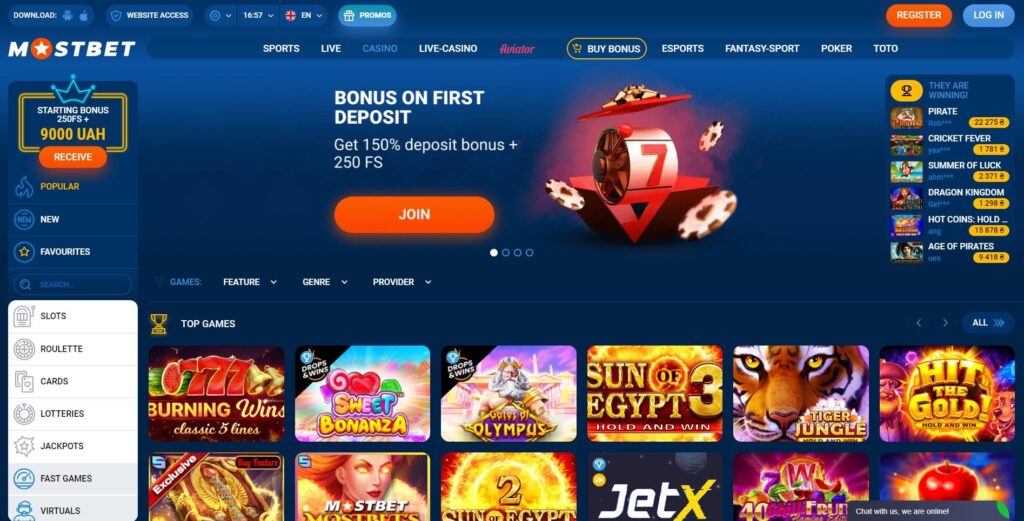

The rise of cryptocurrency has captured the world’s attention, transforming traditional financial systems and sparking debates about the future of money. From Bitcoin’s inception in 2009, cryptocurrencies have challenged the status quo by providing an alternative to fiat currencies. This article delves into the multifaceted impact of cryptocurrency on modern financial systems, including its potential advantages, challenges, and the transformative changes it is catalyzing across the globe. In today’s economy, where digital transactions are becoming the norm, it is crucial to examine how cryptocurrencies are positioned within this landscape. For those interested in the evolving world of online betting, platforms like The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet bd are already integrating cryptocurrency options into their services, demonstrating the wide-reaching implications of digital currencies.

The Advantages of Cryptocurrency

One of the primary advantages of cryptocurrencies is their decentralized nature. Unlike traditional currencies regulated by central banks, cryptocurrencies operate on blockchain technology, which ensures transparency and security through a distributed ledger. This decentralization provides users with greater control over their funds and reduces reliance on intermediaries, such as banks, for transactions. As a result, individuals can send and receive payments with fewer fees and faster transaction times, particularly for international transfers.

Another significant advantage is the potential for financial inclusion. Cryptocurrencies offer solutions for the unbanked populations around the world, enabling them to participate in the global economy without the need for a traditional bank account. For millions of people without access to banking services, cryptocurrencies can provide a means of saving, investing, and conducting transactions securely and efficiently.

Challenges and Risks

Despite their numerous advantages, cryptocurrencies come with inherent risks and challenges that must be addressed. The most pressing concern is the volatility of cryptocurrency prices. Unlike traditional currencies, which tend to have stable values, cryptocurrencies can experience dramatic price fluctuations that may deter potential users and investors. This volatility presents significant challenges for those looking to adopt cryptocurrency as a stable medium of exchange.

Moreover, the regulatory environment surrounding cryptocurrencies is still evolving. Governments and financial regulators worldwide are grappling with how to address these digital assets. Issues such as taxation, anti-money laundering (AML) regulations, and consumer protection are at the forefront of these discussions. The lack of a clear regulatory framework can create uncertainties for businesses and consumers alike, potentially stifling innovation and adoption.

The Impact on Traditional Financial Institutions

The emergence of cryptocurrencies has forced traditional financial institutions to reconsider their business models. Banks and financial service providers are increasingly recognizing the need to adapt to the changing landscape brought about by blockchain technology. Some institutions are exploring ways to harness blockchain for their own operations, enhancing efficiency and security within their systems. Additionally, many banks are investing in cryptocurrency-related initiatives, such as custody services and trading platforms.

Furthermore, cryptocurrencies are challenging the monopolistic nature of financial systems. Decentralized finance (DeFi) has emerged as a disruptive force, enabling peer-to-peer financial transactions that eliminate the need for intermediaries. DeFi platforms allow users to borrow, lend, and trade assets directly, fostering a more open and accessible financial ecosystem. As DeFi grows, traditional financial institutions may need to reassess their roles in the market to remain relevant.

The Future of Cryptocurrency

As we look to the future, the potential for cryptocurrencies to revolutionize financial systems remains promising. Innovations in blockchain technology may pave the way for more scalable and secure solutions, addressing current limitations. The introduction of central bank digital currencies (CBDCs) is also gaining traction as governments explore the possibility of digital versions of their fiat currencies. CBDCs could coexist with cryptocurrencies, providing a state-backed alternative that combines the benefits of digital currencies with the stability of traditional money.

Education and awareness will play critical roles in the mainstream adoption of cryptocurrencies. As more individuals and businesses become familiar with how cryptocurrencies work, their use cases will continue to expand. Institutions and governments that embrace and adapt to this technological shift will likely thrive in the evolving financial landscape.

Conclusion

The impact of cryptocurrency on modern financial systems cannot be underestimated. While challenges and risks exist, the transformative potential of digital currencies is already evident. Decentralization, increased financial inclusion, and innovative financial solutions are just a few of the many ways that cryptocurrencies are reshaping the global economy. As we move forward, a collaborative approach between regulators, traditional financial institutions, and the cryptocurrency community will be crucial in navigating the complexities of this rapidly evolving landscape. Understanding and addressing these challenges will be essential to maximizing the benefits that cryptocurrencies can offer in promoting a fairer and more inclusive financial system for all.

Comments are closed.